Fubo Is in ‘Duel to the Death,’ but Believes It Will Hit Profitability in 2025 Regardless of Lawsuit Outcome

Fubo Is in ‘Duel to the Death,’ but Believes It Will Hit Profitability in 2025 Regardless of Lawsuit Outcome

Fubo’s CEO believes that unfair business practices from Disney, Fox, and WBD has led to “billions of dollars in damages to our business.”

On Friday, sports-focused live TV streaming service Fubo reported its earnings for the fourth quarter of 2023, when it added 141,000 customers at the height of the NFL and college football seasons to hit an all-time record of 1.618 million North American customers, with another 420,000 around the rest of the world. Despite the positive results, a significant portion of the investor call that followed the release was focused on Fubo's lawsuit against Disney, Fox, and Warner Bros. Discovery over the planned fall-launch of a direct-to-consumer (DTC) sports streaming service. As they have since the streamer was announced in early February, Fubo executives did not shy away from discussing how important they believe that this fight is for the future of their company, consumers, and the streaming industry as a whole.

Key Points

- Fubo showed steady, but modest subscriber growth throughout the last three quarters of 2023.

- Co-founder and CEO David Gandler believes Fubo is in a “duel to the death.”

- Regardless of the outcome of the antitrust lawsuit against Disney, Fox, and Warner Bros. Discovery, Fubo believes it will be profitable next year.

Get Your First Month of Fubo for Only $74.99 (normally $95) after your Free Trial.

There are many in the streaming and entertainment industries, including our experts here at The Streamable, that believe that Fubo’s battle with the Disney, Fox, and WBD joint venture is essentially one for the streamer’s survival. While that might seem hyperbolic, Fubo’s co-founder and CEO David Gandler essentially said the same thing in the Friday morning call with investors and analysts when he said that the antitrust suit is one that will determine the future of his platform.

“I think that this is a duel to the death,” Gandler said. “We are fighting for consumers. We are fighting for our customers. We are fighting for the tens of billions of dollars wasted by consumers paying for the same content multiple times. This is a very important process, we are sticking to our principals, to our guns.”

What Is at the Heart of Fubo’s Antitrust Lawsuit Against Disney, Fox, Warner Bros. Discovery?

The combined live sports rights of ESPN, Fox, and WBD amount to a sizable portion of what is available to consumers in the United States, Fubo estimates that it could be as high as 85%. Fubo’s primary argument against this conglomeration of sports rights in a single DTC service is that it believes this leads to an uncompetitive marketplace that would dramatically impact competition and ultimately harm consumers.

In the earnings call on Friday, and in previous comments and press releases, Gandler has referred to this sports streaming joint venture as a “sports cartel” and “sports racketeering.” Fubo alleges in its lawsuit that these companies have systematically targeted the sports-aimed streamer with excessive licensing rates and non-market penetration requirements, as well as unfair bundling requirements that not only drive up the cost of the service but also force consumers to pay for channels that they are not interested in.

All the while, Disney, Fox, and WBD are now coming together, according to Gandler, in an effort to recreate Fubo’s initial business model of providing cord-cutters access to a sport-focused streaming service at a cost under that of traditional cable and satellite subscriptions. The streamer believes that had it been given contract terms in line with those of other live TV streaming services, it could have possibly broken even in 2023, rather than still working at a deficit.

“We assert that this JV is an attempt to monopolize the sports streaming industry and eliminate competition,” Gandler said on Friday. “Their proposed venture is, we believe, just the latest example of this sports cartel’s attempt to block and steal Fubo’s vision of what a sports streaming bundle should look like, resulting in billions of dollars in damages to our business. We consider the defendant’s pernicious contractual terms and other anti-competitive practices borderline racketeering.”

Despite noting how vital Fubo’s fight with the forthcoming Disney, Fox, and WBD joint streaming service is, Gandler also suggested that no matter the result of its lawsuit, Fubo would still be on track to hit its profitability goals by 2025.

“The last four quarters we’ve really delivered on the bottom line,” he said. “This last quarter was a really impressive move. An improvement of $100 of free cash flow really demonstrates our commitment to achieving our profitability targets. That doesn’t mean it’s going to be an easy road, but this company has demonstrated time and time again its resilience.”

Fubo is hoping that either its lawsuit against the proposed joint venture, an investigation by the Department of Justice, or concerns from major sports leagues including the NFL will prevent the yet-to-be-named sports streamer from getting off the ground this fall as planned. If Disney, Fox, and WBD are able to move forward with their planned streamer, it will have a significant portion of the broadcast rights to the NFL, NBA, WNBA, MLB, NHL, NASCAR, college football, college basketball, UFC, PGA TOUR Golf, Grand Slam Tennis, the FIFA World Cup, and more.

The fact that estimates are pegging the streamer’s cost at approximately $50 per month, and that it will include non-sports programming from multiple entertainment channels owned by the participating companies, it is clear to see why it would pose an existential threat to Fubo’s future.

Fubo, which costs over $90 per month, currently does not carry Warner Bros. Discovery-owned channels TBS, TNT, or truTV, despite their substantial collection of sports rights. Therefore, if customers were to sign up for the sports JV and add on Peacock and Paramount+ for $11.99 per month each in order to round out the sports offerings, they would still be paying significantly less than Fubo on a monthly basis. While neither streamer would offer all of the content that the other has (Fubo offers regional sports networks that would not be available on the joint venture streamer), it does present a challenge to Fubo.

However, some legal and business analysts point out that antitrust laws are not designed to protect companies from competition, but to instead make sure that a lack of competition does not adversely impact consumers. Therefore, if the price of the trio of companies’ JV provides a cheaper alternative to what is already on the market, it might be difficult for Fubo to make its case in court.

Nonetheless, CEO David Gandler and company are actively laying out their position that Disney, Fox, and Warner Bros. Discovery have been actively involved — either independently or collectively — in a pernicious campaign to make Fubo’s business model unsustainable in order to essentially steal the sports-focused streaming strategy for themselves. Will the argument be enough to sustain — and even enhance — Fubo’s recent successes for the longterm? Only time will tell.

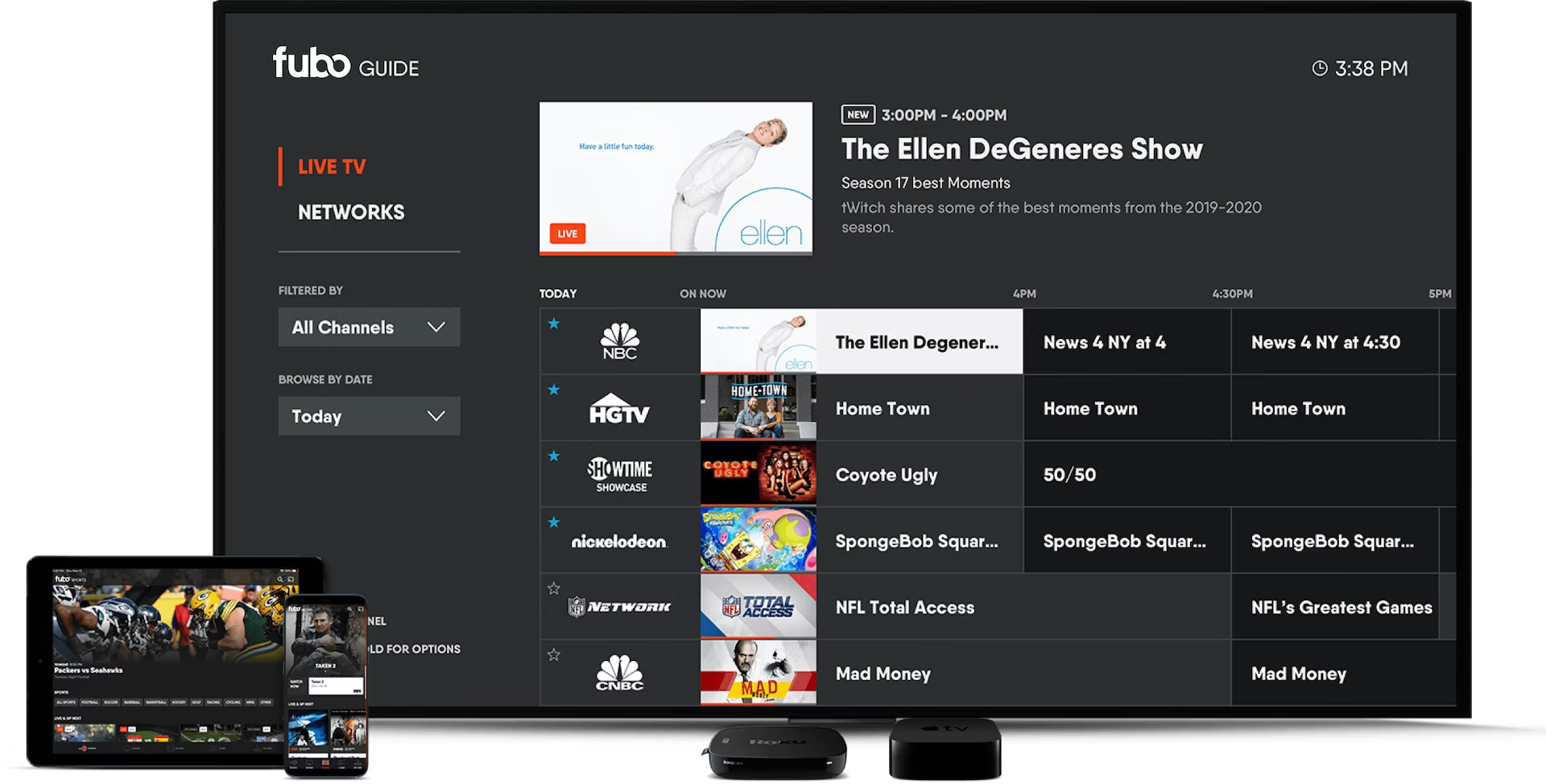

Fubo

Fubo is a live TV streaming service with about 90 top channels that start at $79.99 per month. This plan includes local channels, 19 of the top 35 cable channels, and regional sports networks (RSNs). In total, you should expect to pay about $94.99 per month, after adding in their RSN Fee. Fubo was previously known as “fuboTV.”